A song to read by: “Face to Face,” by Daft Punk

What I’m reading: “Money,” by Martin Amis

Published this week

— How Hodinkee's Big Bet on a Watch Business Backfired

— Spotify's Plan to Monetize Live Events

On my mind

A very odd publisher officially debuted this week, whose highly atypical business model is indicative of some of the ways in which the media industry is changing.

Called Hunterbrook, the publisher monetizes its coverage in a way that I have never seen before. To start, the company basically doubles as a hedge fund, and its newsroom acts like a team of research analysts.

The news staff of around 20 work to publish investigative stories about major companies, but before it publishes the information it takes a series of financial positions that will allow it to make money when the news comes out, such as shorting the stock of a company that is the object of its critical reporting.

For instance, in its investigation about a major mortgage lender, it shorted the company and bought stock in one of its primary competitors. It is also monetizing the market-moving information in other ways, such as sharing its reporting with shareholder litigation firms in the hopes that, if they sue the company, Hunterbrook will financially benefit from the lawsuit.

Matt Levine has a great write-up of Hunterbrook here. He is the perfect man to cover this story because one of his long-running bits is that everything is securities fraud. If securities fraud involves making investments based on non-public information, his argument goes, then effectively all investing is securities fraud. After all, you wouldn’t invest in something if you didn’t have some reason, tangible or otherwise, to think that its performance will improve in the future, right?

But Hunterbrook takes this concept to another degree. It finances reporting that will move markets, then makes investments that will allow it to anticipate and benefit from those movements.

The founders of the company are transparent about the fact that the model is an experiment and could fail. And there are a lot of reasons to doubt that this will be viable in the long run. For starters, the whole concept rests on the premise that this newsroom can produce a steady stream of original, deeply reported investigative pieces about public companies. That is not easy to do!

Obviously it is backed by a hedge fund, so that gives it a degree of runway that other startup publishers would kill for. But I have to also wonder about the cash flow challenges of this kind of operation — salaries need to be paid twice a month, regardless of whether whatever financial positions the company has taken are throwing off revenue at the moment.

Still, I love the idea, if nothing else, for its originality. If something like this can work out, it might encourage other similar publishers. And the kind of journalism it is incentivized to produce — deeply reported exposes about powerful companies with something to hide — is both critical and hard to finance through existing models.

But I also think it gets at a notion I have been thinking about more and more, which is that as the media ecosystem continues to shake out, the most durable newsrooms will be the ones that offer reporting that is effectively data, or information, rather than entertainment.

This sentiment has been echoed by other media pundits, who typically frame the issue as a divide between business-to-business publishers and business-to-consumer publishers. The former are facing mounting existential challenges, both from social media and soon artificial intelligence.

In short, any kind of reporting that is a recombination of existing information will soon be made obsolete; the only kind of news coverage that has any degree of insulation from the coming AI revolution is information that exists nowhere else in the world, information that you have brought together through reporting.

Hunterbrook takes this to an extreme, but its core thesis reflects the direction in which the broader media world is moving. If your reporting is anything less than completely original, something that does not exist in any form elsewhere and could not be produced by a machine with access to all the preexisting information on the internet, then it is at risk!

Naturally such reporting is incredibly hard to do, but Hunterbrook does not promise to produce dozens of these stories on a regular basis. It acknowledges that these kinds of exposes will take time to come together, and it has built a model that, at least in theory, allows it to run sustainably on intermittent output.

The week that was

This last week the weather was horrendous and the mood in the city was quite sedate. I did get drinks in Williamsburg on Thursday with a very insightful source, and of course the earthquake Friday provided plenty of shared small talk for the rest of the weekend.

I got drinks on Friday with a friend at Sally’s in Bed-Stuy, then watched the Iowa game. Saturday I spent walking the city and shopping with my friend Aleks Chan, a former Gawker and Splinter writer who had thoughts on the ongoing disassembly of G/O Media. I met up with an Austin friend, Will Maxwell, who moved to the city just two months ago, and on Sunday I finally got to eat at Mắm, with Terry Nguyen.

I’m writing this from a coffee shop in the West Village, as the weather today has been wonderful, but I’ve kept it relatively brief because now I need to go catch the NCAA Women’s championship! I’m pulling for Iowa because Caitlyn Clark has been unreal.

One good rumor

I heard recently that Shane Smith’s attempts to buy back Vice are quite serious and not entirely unrealistic. After all, why would Fortress et al. not sell if they got a good enough offer? All Shane needs is a handful of Saudi sheikhs with a few billion to blow and we might be back in business.

Some good readin’

I didn’t read anything good this week, honestly! I’m as bummed about it as you are.

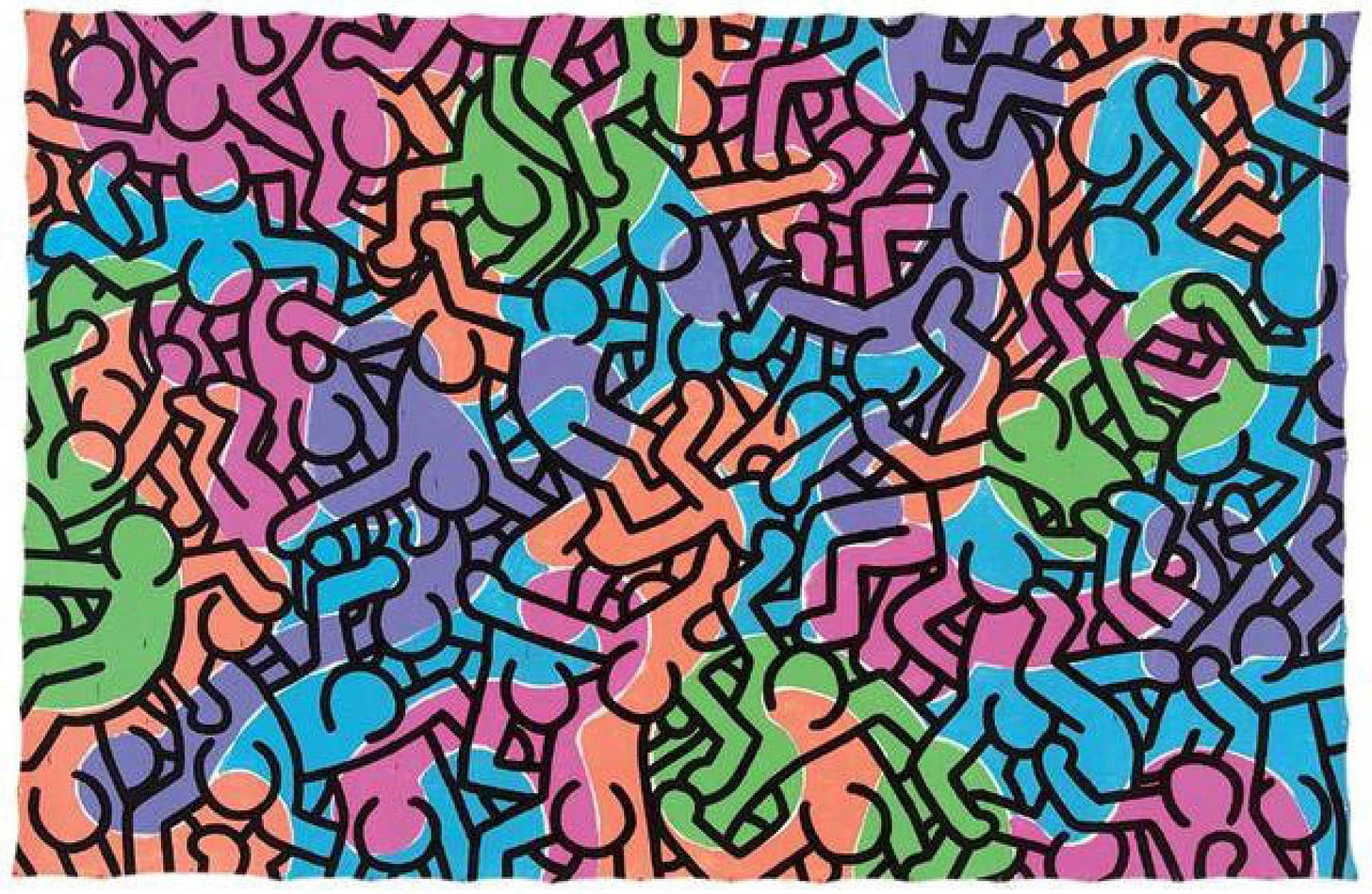

Cover image: “Untitled (People),” by Keith Haring